Key questions and answers around energy trading

Provider

What is energy trading actually? And why do we need it? You can find the answers to these questions – and many others on the subject of energy trading – in the FAQ below.

For many of the goods that we use in our day-to-day lives, we can simply stockpile. For example – you might buy certain food items at the beginning of the week to then store them and only consume them on the weekend. But we can’t store electricity like that. BKW, and anyone else who produces electricity, has to find a recipient at the moment the power is generated. And this is precisely where energy trading comes in. At every moment of every day, it maintains an essential balance between supply and demand for electricity. And not just within national borders, either. Because Switzerland is integrated into the European energy system, electricity supply and demand has to balance out at the European level.

So first, BKW energy trading ensures maximum efficiency in the use of electricity. It brings producers and consumers together, and energy suppliers with their own power plants are able to hedge their production ahead of time (see question 4). Second, trading guarantees the flexibility required for short-term offsetting of fluctuations in electricity production. And third, energy trading ensures that our electricity grid functions reliably, which requires a constant balance between electricity production and consumption. Without this we would be faced with either a shortfall (demand greater than supply) or overload (supply greater than demand) in the European electricity grid, which could lead to power outages. In the worst case scenario this could even result in the collapse of the grid.

The energy transition will require a massive expansion of renewable energies – wind, hydropower and solar energy. Yet these sources are heavily dependent on weather; days may go by without a breath of wind, weeks can pass without rain, thick clouds may cover the sun. With renewable energies, we only know on a short-term basis how much electricity they will actually produce. To balance out this uncertainty, we use short-term energy trading – “intraday trading” – at quarter-hour intervals (see question 6). And that’s becoming harder – as the share of renewable energies in Europe increases, we are seeing greater production fluctuations in the electricity grid. BKW is able to offset these changes with intraday trading and by activating or deactivating its own flexible power plants. Together, intraday trading and BKW power plants make a powerful contribution to customer supply as well as grid stability.

With basic supply, BKW knows ahead of time how many customers it has to supply, and when. So BKW “reserves” the forecast volume of basic supply out of the overall production volume from its power plants, three years prior to the point of delivery.

It’s a different situation for customers in the free market – that is, large-scale consumers with annual electricity requirements in excess of 100,000 kilowatt hours. They can choose for themselves whether to purchase their electricity from BKW, or from another energy supplier. BKW also hedges its production volume (minus the “reserved” portion for basic supply) three years ahead of time on the energy exchange; in other words, BKW “sells” this electricity. If BKW enters into an electricity supply contract with a customer in the free market, it purchases the required electricity back from the exchange upon concluding the contract. Market customers can conclude contracts with BKW up to six years ahead of the actual point of delivery. This type of contract offers manufacturing companies and other large-scale consumers predictable electricity prices and guaranteed electricity supply at a certain point in time.

Energy trading is generally broken down into the following three main areas, which BKW observes as well:

- Hedging of electricity production from the company’s own power plants, known as “asset-backed trading”

- Customer business (“origination”)

- “Proprietary trading”, also known as “prop trading”

The first area, hedging of the company’s own electricity production, only applies to energy suppliers that have their own power plants – like BKW. BKW can forecast the production volume of its power plant portfolio to a high degree of accuracy – despite weather-related uncertainties in hydropower, wind and solar plants. But market prices for electricity are harder to predict. For energy suppliers this has the disadvantage that they cannot estimate their future revenues from the sale of electricity. And the purchaser doesn’t know how much it will have to pay for a certain volume of electricity. So energy suppliers like BKW hedge their electricity production up to six years in advance for a future delivery date – at a price currently offered on the market for supply of electricity at exactly that point in time. This all happens on the long-term futures market (see question 5).

The second major area in energy trading, customer business, brings vendors and purchasers of electricity together – under long-term electricity contracts known as “power purchase agreements” (PPA), for instance. This comes with benefits for both parties. The vendor can sell a certain volume of electricity at a fixed price in advance, while the purchaser has the security of knowing that it will be able to draw down this electricity later at the agreed price. This type of PPA also promotes the expansion of renewable energies, as the market price risks for these energy sources are particularly high. A PPA gives wind, hydropower and solar electricity producers guaranteed revenues, while the purchaser receives a long-term supply of sustainable electricity. In 2021, for example, BKW entered into a long-term electricity supply contract with Swiss retail chain Denner (information in German).

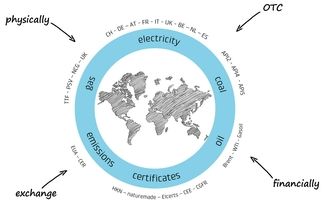

The third major area of energy trading is proprietary trading. This is often (and erroneously) taken to mean trading of “electricity from the company’s own power plants”. But in fact the opposite is true – proprietary trading refers to an energy supplier’s trading of third-party commodities. And not just electricity: they also trade in natural gas, oil, CO2 certificates, precious metals and many other commodities. But why? The demand for energy is dependent on economic conditions, among other things. When the economy is booming, there is greater production and demand for goods. And that in turn drives energy consumption, and with it the price of electricity. So a good energy trading department will have a total overview of the trading market in Europe and throughout the world. That’s because the market price of electricity is partly determined by the prices for natural gas and oil. And the volume of available CO2 certificates can also influence this price. So it’s important that traders stay on the ball and monitor market prices for a range of commodities. First and foremost, BKW uses proprietary trading to support and optimise the management of its own production facilities. To achieve this, BKW applies a range of different hedging strategies, depending on the type of power plant. Proprietary trading also allows BKW to retain an active presence on the market and to constantly improve the quality of its hedging strategies using available products and price developments on the futures and spot markets.

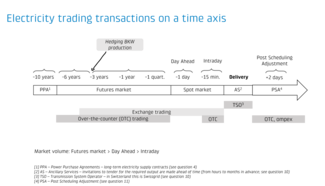

The difference between these two markets is the length of time until the agreed delivery date for the electricity traded.

On the futures market, parties conclude long-term electricity supply contracts with a lead time of up to six years, but generally three years. For instance, energy suppliers with their own production facilities, such as BKW, can use the futures market to hedge their own electricity production (see question 4). The spot market, on the other hand, is the place for trading deliveries of electricity in the short term (“on the spot”) – one or two days out. The spot market is further broken down into day-ahead and intraday markets (see question 6). The diagram above in this FAQ shows trading transactions on a time axis.

Both day-ahead and intraday trading are functions of the spot market, where short-term trading of electricity (see question 5) takes place every day of the year.

The day-ahead market involves trading electricity deliveries for each hour of the following day. Suppliers have to enter their prices by midday of the day before. The exchange then uses these offer prices to determine the market price, and around an hour later it announces whose bids have been accepted for each hour of the following day at the calculated market price.

In intraday trading, electricity is generally supplied in blocks of between 15 minutes and an hour. This option of trading to within quarter-hour accuracy is probably the most significant feature of intraday trading. Intraday transactions begin at 3 p.m. of the day prior to delivery. The quarter-hour and hour blocks can then be traded on a rolling basis for the following day. And electricity can still be traded on the day of delivery itself – up to five minutes before the point of delivery. The reason for this particularly short lead time is the increase in weather-dependent energy sources such as wind, solar and hydropower, where feed-in rates are difficult to forecast (see question 2). The aim is to give electricity traders the opportunity of trading their electricity volumes on a more short-term basis, which makes it easier for them to manage their portfolios. As this blog post (in German) explains, intraday trading is vital for offsetting fluctuations between supply and demand in the electricity grid, which in turn strengthens the reliability of supply in Switzerland and throughout Europe.

One key difference between day-ahead and intraday trading is in the pricing. On the day-ahead market, the price for a delivery of electricity at a certain time of the following day is derived from overall market activities (the “merit order” principle; see box). But intraday trading requires nothing more than a vendor and a purchaser whose price expectations match. That’s why we refer to the “pay as bid” process and “bid prices” in intraday trading. This means that the price that receives the bid at the point of the trade applies. Consequently, in intraday trading it is possible for the same product to have varying prices at different trading times.

The merit order principle: the basis for electricity pricing in the energy market

The term “merit order” may seem unusual, but the concept is actually very straightforward. In energy trading, the merit order principle determines which type of power plant is used in which order to meet demand for electricity. It is the short run marginal cost of a power plant that determines its suitability – in other words, the cost incurred for each additional kilowatt hour of electricity. These marginal costs are currently highest in coal- and gas-driven power plants, because of the high price of the fuel itself as well as CO2 certificates. This means that coal- and gas-driven power plants are usually the last to be activated to meet demand for electricity. And under the merit order principle, the marginal costs of the last power plant deployed – the power plant with the highest marginal costs – determines the market price of electricity in wholesale trading. One exception is pricing in intraday trading, which is based on bid prices (see question 6). This means that the key drivers of pricing in energy trading are the prices for natural gas, oil and CO2 certificates, which are subject to major fluctuation. Other key factors that influence market prices for electricity are geopolitical conditions, the high degree of uncertainty in potential agreements between Switzerland and the EU regarding the electricity sector, the phasing out of nuclear and coal-powered plants throughout Europe, and general trends in electricity demand, such as increased electromobility.

“Over the counter” (OTC) is one of the options for trading electricity outside of the exchange. In OTC transactions, a vendor and a purchaser agree on a set price per megawatt hour for a delivery of electricity – a certain volume at a defined point in the future. Because the parties trust each other, they don’t demand further “securities” that would offer protection if the vendor doesn’t supply the electricity as agreed, or if the purchaser can’t take delivery.

But in international energy trading through an exchange, the offer and bid parties generally don’t know each other personally, so you don’t often find this kind of trusting relationship. Therefore the parties will demand securities from each other in the form of collateral.

Futures trades on the exchange are very straightforward. But the electricity is traded anonymously, which makes reciprocal securities even more important. Consequently, European energy exchanges demand collateral for long-term trading transactions. This is a safeguard that says: even in the event of a slump in production, the energy companies will procure the required energy on the market so it can supply its customers.

There are two forms of collateral. The first is the “initial margin”, which is deposited when the transaction is made; this covers the credit risk of the contractual parties. This can be adjusted during the term of the transaction – if there is a major fluctuation in the price of electricity on the market, for instance. The second is the “variation margin”, which is applied daily as a means of compensating for day-to-day changes in the market value of the transaction. When electricity prices rise, the cost of collateral rises with them. That’s because it becomes much more expensive for a company to acquire the required electricity on the market. If the market price of electricity rises rapidly, with major fluctuations, the vendor also has to compensate for the loss of market value in the trading transaction and pay for the increase in the initial margin. When the exchange demands additional funds in this context, it’s referred to as a “margin call”. In the event of a rise in electricity prices, the extra collateral must be transferred to the exchange within 48 hours. The energy companies get the collateral back upon performance of the contract, i.e. the delivery of the electricity.

No. While the dynamism of the energy market is increasing demand for liquidity in general (see question 8), BKW has well-structured risk management and a solid liquidity position, so it is not seeing bottlenecks in liquidity. BKW is monitoring developments closely and constantly adapting its financing to current developments. For example, since early 2022, BKW has been winding down its trading positions. BKW does not enter into risk that it cannot manage under its own steam, so it hasn’t applied for state support and has no plans to either.

Reliable, secure operation of the electricity grid requires a constant balance between production and consumption of electricity. At any given point, the amount of electricity being fed into the grid must match the amount being consumed, to maintain a constant frequency of 50 hertz. The activities required to keep grid operations secure are called “ancillary services” (AS). Responsibility for these services lies with the national transmission system operator, which in the case of Switzerland is Swissgrid. In the event of unforeseen fluctuations, Swissgrid procures “control power” by ordering power plants to increase or reduce their production. To ensure that control power is then actually available when demand is expected, Swissgrid tenders for the required volume of control power on its own control energy market. Producers of electricity from variable plants – such as hydropower and biogas power plants – participate in this market. This includes BKW, which can post bids for the tendered control power delivery at a certain price. If BKW’s bid is successful, it undertakes to make the defined control power available to Swissgrid on the agreed date. If Swissgrid does in fact call on the control power, BKW receives additional compensation for the control power it supplies.

Balance groups are “energy accounts”, which each comprise a number of different energy suppliers. Each balance group has its own balance group manager. The manager can enter into energy transactions with other balance group managers – both domestic and international – get energy from power plants and supply end consumers with energy. Post-scheduling adjustment (PSA) offers balance groups whose “energy accounts” are “unbalanced” the opportunity to offset with other balance groups through contrary positions up to two days after a delivery of electricity to avoid or reduce the need for costly balance energy. These transactions can also be conducted on specialist platforms, such as Ompex. The adjusted energy positions are then reported to the grid operator through “post-scheduling”.

Facts about BKW energy trading

The 100 or so employees of the Energy Trading division work from the trading floor of the BKW head office in Bern. They take care of all of BKW’s trading transactions, both short-term (intraday and day ahead market) and long-term (futures market and power purchase agreements, or PPA). Members of the twelve-strong Intraday department are at work 24 hours a day, seven days a week, trading in quarter-hourly to hourly blocks. Each year BKW makes around 1,500,000 trading transactions. At BKW, energy trading is broken down into three main areas: hedging of electricity production from its own power plants; customer business with long-term supply contracts between the electricity vendor and purchaser (PPA); and proprietary trading, the buying and selling of third-party commodities which gives the BKW trading floor a good overall view of trading activity throughout the world.

Commercial products and contacts

Are you looking for a trading partner for electricity, gas, oil, coal, emissions or certificates? BKW is interested in establishing trading relationships and concluding framework agreements with solid companies.

Our focus is on the sales territories of Switzerland, Germany, Austria, France, Italy, the UK, Belgium, the Netherlands and Spain. Our diverse and, above all, exceptionally flexible electricity generation portfolio puts us in a particularly strong position to offer flexible marketing of physical and financial assets from the short to long term.

| Long-term trading | +41 58 477 63 11 | [email protected] |

| Spot trading | +41 58 477 54 22 | |

| Certificate trading | +41 58 477 59 83 | [email protected] |

| Asset trading | +41 58 477 64 66 | [email protected] |

| Structured trading | +41 58 477 52 29 | [email protected] |

| Intraday trading | +41 58 477 64 66 | [email protected] |

| Ancillary services | +41 58 477 43 25 | [email protected] |

| Legal | +41 58 477 54 04 | [email protected] |